The world is certainly feeling the squeeze from the slowdown in economic activity as a result of the coronavirus outbreak. This is usually bullish for commodities such as gold and silver, but even those are falling. So what is a safe haven?

The world’s stock markets have shed record levels this week, with those in Asia getting hit the hardest. During times of economic adversity, stocks are usually the first investment to be sold off.

Crypto markets have also taken a huge hit, dumping $40 billion, or almost 14%, since the beginning of the week. Many digital assets were overdue a correction, but the current situation has not helped matters.

Traditional safe-haven assets such as gold and silver are also taking a hit, which begs the question: what exactly is a ‘safe haven’?

Silver Locked Limit

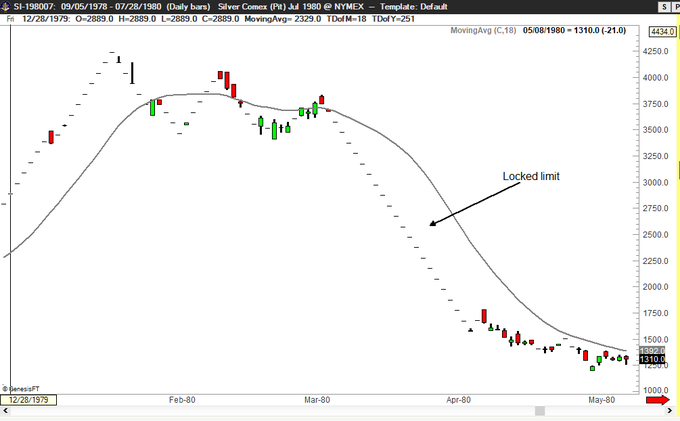

Industry expert and chart guru Peter Brandt has been taking a look at the seldom mentioned sliver charts and observed that it was “locked-limit” down on Friday.

Silver has been "locked-limit" down today. Buyers must provide liquidity for owners of contract to liquidate their trades.In 1980, Silver was locked limit down for more than four weeks during a $20/oz. decline. The Hunts were stuck.

Silver has been "locked-limit" down today. Buyers must provide liquidity for owners of contract to liquidate their trades.In 1980, Silver was locked limit down for more than four weeks during a $20/oz. decline. The Hunts were stuck.

65 people are talking about this

A lock limit is a specified price movement determined by trading exchanges that if breached, results in a trading halt of that asset beyond the lock limit price. It helps regulate markets and keeps them calmer and more orderly as trading is halted outside of the lock limit price. Locked limit periods are variable from five minutes to a whole day and are very rarely put in place.

Silver prices have dumped 10%, according to reports, and analysts expect further declines in what has traditionally been a very stable commodity.

Almost half of the physical demand for silver comes from the industrial sector, which is currently being battered as trade routes and supply chains are disrupted.

Safe-Haven Gold Retreating

Gold has performed well this year and has reached a seven-year high. But prices have also plunged 2% this week in a fall back to $1,640/oz, according to the charts.

Theoretically the safe-haven asset should be climbing even further, so the retrace goes against all claims by Bitcoin bashers such as Peter Schiff. It is possible that gold is being sold by traders who need to meet margin calls elsewhere.

Gold is still up on the year, as is Bitcoin, but the recent selloff has called into question the safe-haven properties of all assets.

In times of total anarchy, which we are a long way away from yet, the preppers will have you believe that the only ‘safe haven’ is a room full of tinned spam, fresh water, and lots of guns.

Until then, Bitcoin and gold still fit the description rather well.

No comments:

Post a Comment