Warren Buffett claims crypto “attracts charlatans.” This is funny since the word has no truly fixed meaning. Subjective at best, a charlatan is “a person falsely claiming to have a special knowledge or skill; a fraud.” While the Bitcoin world isn’t lacking for such people, the fact is that we have plenty of native experts. People who’ve watched crypto markets throughout their tenure.

WARREN BUFFETT CONTINUES NON-STOP BITCOIN BASHING BRIGADE

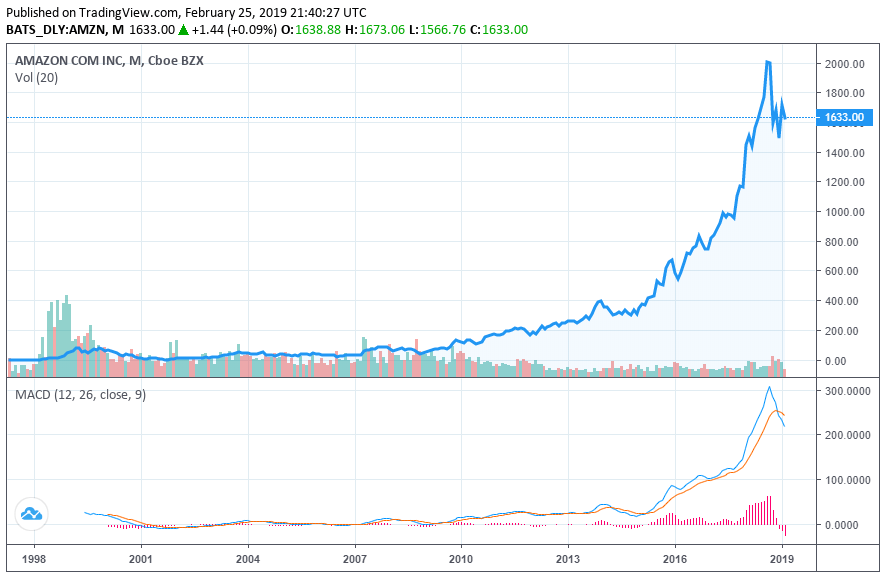

He’s called the “Oracle of Omaha” because many people take his advice. Amazon was not a pick of his, and now it’s the most valuable company in the world. It takes more than $3,800 to acquire a single Bitcoin these days, but he reportedly remains against it.

We have to question what makes someone qualified to speak on the subject of cryptocurrencies. Any metrics we develop will immediately discount someone like Warren Buffett, who admittedly has no direct knowledge of how Bitcoin works. Does getting rich in Bitcoin make someone a Bitcoin expert? Nope, that doesn’t work either. There are plenty of Bitcoin millionaires out there, and most of them couldn’t generate a custom transaction or set up a cryptocurrency miner.

The technological side of Bitcoin is extremely important if we’re going to take someone’s opinion of the cryptocurrency seriously. A lack of understanding the actual limitations of the Bitcoin network has driven plenty of people to the folly of some altcoins which boast “throughput.” There are many times that Bitcoin makes no economic sense, but perfect blockchain sense. Why should someone pay three times the price to send a transaction as the day before? Block congestion, of course, and the block size limit.

FIRST AMAZON, NOW BITCOIN – WHEN WILL BUFFETT LEARN?

Buffett admittedly missed the boat on Amazon. He lacked faith in the CEO, Jeff Bezos, and had no regard for the juggernaut of e-commerce. This goes in line with his other decisions, throughout his history. The hostile takeover of Berkshire Hathaway itself was a folly for the ages. Buffett has admitted it was a stupid acquisition based on being slighted by the company in a liquidation offer.

So, you can take Buffett’s opinion seriously if you like. But I prefer to trust a mixture of myself and people who actually know what they’re talking about. Technologists like Bill Gates and Jack Dorsey have a much greater opinion of cryptocurrencies. They’ve spent their careers watching technology change every aspect of society. When I was a kid, you could go a whole week without interacting with any part of the internet. Maybe several months if you didn’t watch TV, which is where we heard the most about the thing.

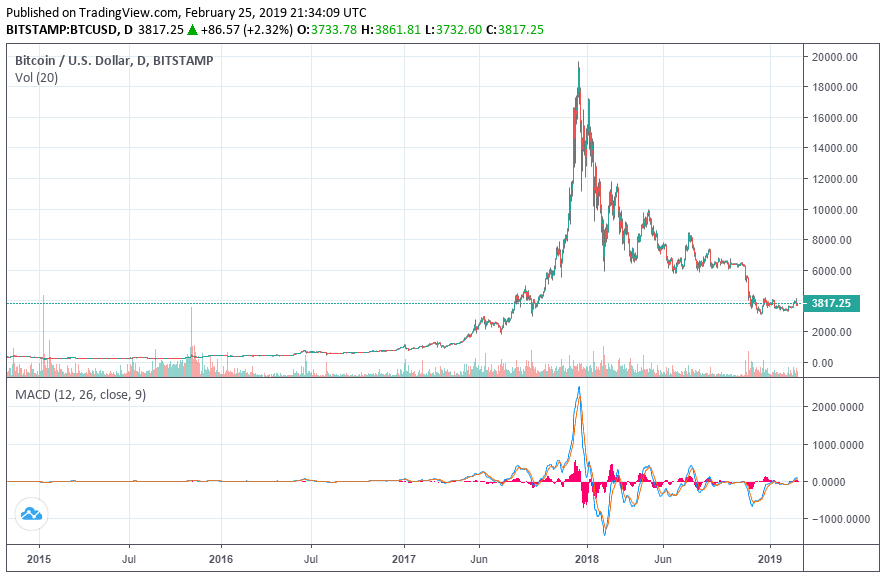

Now? The internet powers everything. The blockchain is the Internet of Money, and while it may have a lot more volatility to come in terms of market valuations, its value proposition is strong. It creates a globally solid use case. Eventually, I believe, a use case will come along which will make the blockchain indispensable, in the same way that the internet now is.

It will be something vital to humanity, perhaps even something non-financial, like the distribution or management of public resources. At that point, there’s no turning back. In the same way, it’s now difficult to imagine an offline society, it will be difficult for most people to imagine a world in which cryptocurrencies don’t exist.

BITCOIN TRADING ISN’T FOR NOOBS

The Bitcoin price is volatile, but that doesn’t mean that investors should stay away – just that they should be careful. | Source: TradingView

Does that mean you should bet your house on the Bitcoin price? Certainly not. In fact, I wouldn’t recommend non-long-term trading to anyone who isn’t a professional trader already. It’s not for the faint of heart by any stretch. If anything, put some funds with a manager who will invest them for you, and ask to have some kept in crypto.

But listening to someone like Warren Buffett at this point in history when it comes to something like Bitcoin is a fallacy all its own. The man didn’t believe in the world’s most valuable company enough to invest, and now he’s telling you to avoid the world’s most valuable cryptocurrency.

Will Bitcoin always be king of crypto? I tend to think that’s a debatable question. One thing is for certain: the maximalist argument that all useful innovations from altcoins will be integrated into Bitcoin has never come to pass. Drunk on years of potential overpricing fueled by potentially fictitious volume and liquidity, the Bitcoin goliath could certainly fall to the sling of some David crypto. (Have you logged into MySpace lately?)

As it stands, Warren Buffett is just another no-coiner bloviating about things he doesn’t understand. A less successful or arrogant man might have simply said he had no opinion on things he didn’t comprehend. Jamie Dimon and Warren Buffett should get together and take up Morgan Creek on their bet.

Warren Buffett Image from Bill Pugliano / Getty Images / AFP. Price Charts from TradingView.

No comments:

Post a Comment