The latest CryptoCompare Exchange Review states that the crypto derivatives volumes during the month of May 2020 soared to an all-time high of $602 billion, after registering a growth of 32%. Even the spot trading volumes registered an uptick of just 5% to $1.27 trillion during the same period.

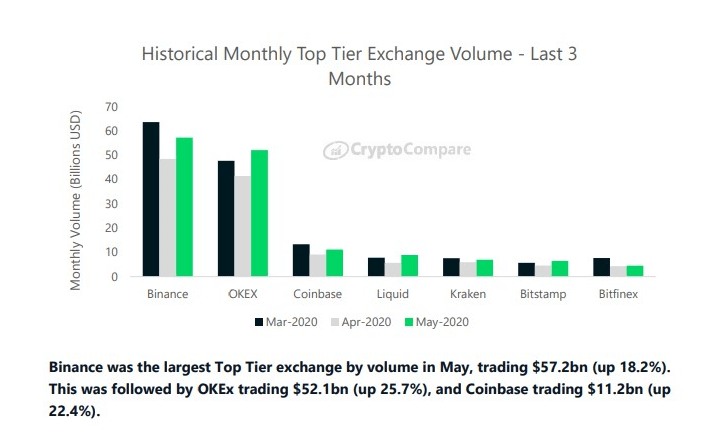

According to the report, trade volumes on OKEx surged the highest among the top-tier exchanges in May as compared to April. The percentage change over a period of one month on OKEx was 25.7% at $52.1 billion as compared to Binance at +18.2% and Coinbase at +22.4% The trade volumes on Binance and Coinbase during May 2020 stood at $57.2 billion and $11.2 billion, respectively.

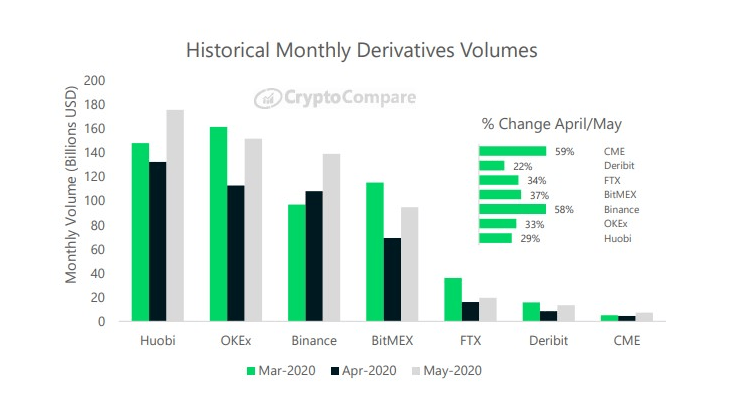

The month on month crypto derivatives volumes witnessed a huge surge in the month of May 2020, with institutional player CME gaining 59% to $7.2 billion. When it comes to derivatives exchanges, Huobi continued to lead the race with monthly volumes of $176 billion, trailed by OKEx at $152 billion with a 33% month-on-month increase from April 2020 which puts it at the second spot.

Apart from being a world-class derivative and spot trading platform, OKEx is strengthening its options trading portfolio by launching new instruments. Its first offering, the BTC/USD options has registered an average daily transaction volume of $10 million. Recently, OKEx also released ETH/USD options, which will soon be followed by EOS/USD options on June 18.

At this pace, OKEx may end up taking the top spot for being one of the best options trading platforms as well.

No comments:

Post a Comment