The number of daily transactions occurring on the Dash network has been rising slowly but steadily over the last year. In fact, there are now more transactions being performed using the crypto asset than there are on the Litecoin network.

Despite the network’s growing usage, the total Dash market capitalisation still lags a long way behind that of Litecoin. For some, this suggests that the market is not yet mature enough to determine real utility in crypto assets.

Dash Transactions Outpace Litecoin but ‘Flippening’ Still Looks a Long Way Away

At the time of writing, Dash currently sits in 22nd place on popular crypto asset comparison website CoinMarketCap. Even after a 24-hour pump of more than eight percent, the digital currency still only boasts a market capitalisation of just over half a billion dollars.

With Bitcoin still representing the asset with the hardest monetary policy in human history, other cryptocurrencies compete to fill different niches. One of the most prominent, and the one that Dash seems most suited toward, is a fast, decentralised means of payment.

Litecoin is currently positioned much higher on CoinMarketCap’s listings, in sixth place. It has a total market capitalisation of more than $3.253 billion.

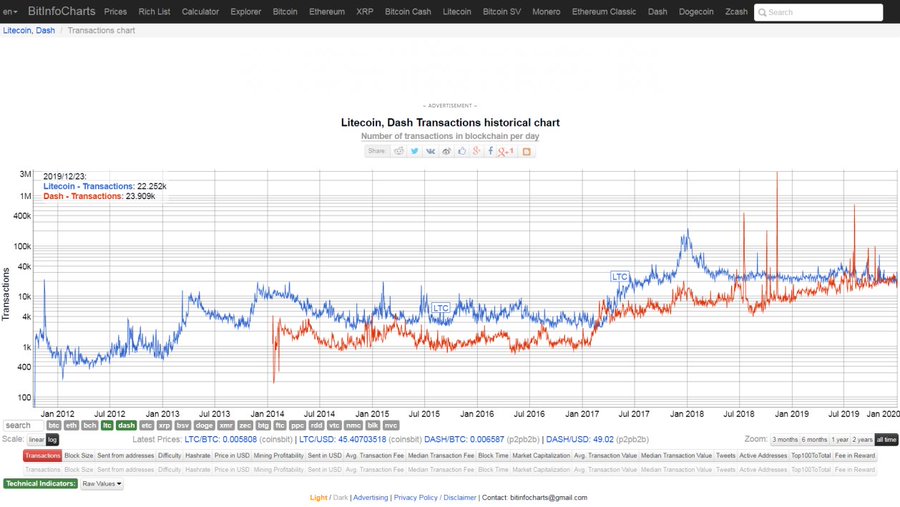

Interestingly, daily transaction volume of these two crypto assets does not show the same Litecoin dominance. According to data from BitInfoCharts.com, the number of transaction occurring on the Dash network has been growing over the last year or two. Meanwhile, Litecoin usage has been dwindling.

For some commentators on the crypto industry, the fact that both Dash and Litecoin now boast a very similar total daily transaction volume but widely different market caps is evidence that the digital currency market is not yet mature enough to value assets based on overall utility. Twitter user ~C4Chaos (@c4chaos) argues that this will not always be the case and those cryptos seeing most usage will eventually rise to the top.

See ~C4Chaos's other Tweets

No comments:

Post a Comment