Over the course of 2019, volatility has played a major role in dictating the price of crypto-assets. Major price swings during April-June saw the collective cryptocurrency market improve its valuation. However, the 2nd half of the year has been extremely bearish for the market, apart from the flash hike recorded on the 25th of October.

Source: Trading View

Despite losing close to 50 percent of its valuation since hitting $337, Ether’s volatility has been pretty restricted over the past few weeks. Over the past 50 days, Ethereum’s average price movement is only about 8.37 percent from 26 September to the present day. In comparison, the previous 50 days recorded a swing of over 40 percent.

According to skew markets, ETH/USD’s realized volatility is closing to its all-time low after moving only an average of 1.73 percent in the last 10 days.

During the course of September, Ethereum was performing better than Bitcoin for a brief period of time as sentiment on various derivatives platforms turned bullish. Various Futures contracts on Deribit were placed based on the prediction of ETH closing at $600 by the end of December.

The probability of a 200 percent surge is not really likely at the moment as the community speculates that ETH is entering another major accumulation phase before a potential bull run next year.

Source: Coinmetrics

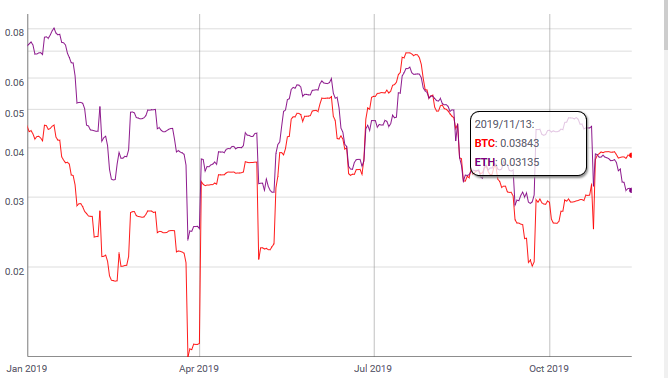

In comparison, Bitcoin registered a slightly higher volatility index in terms of daily returns calculated over 30 days. ETH registered its lowest daily returns on 26 March with 0.0236.

At press time, Ethereum was valued at $184.29. The valuation of ETH has been consistently between $170 and $190 since 26 October, and the next few weeks will be critical for Ethereum’s valuation and the overall volatility of its price.

No comments:

Post a Comment