Bitcoin and blockchain expertise in the insurance industry has “exploded” over the past two years, and insurers who ignore blockchain technology do so at their own peril, according to a new report from Aite Group, a global research and advisory firm.

INSURANCE PROFESSIONALS ARE BONING UP ON BITCOIN

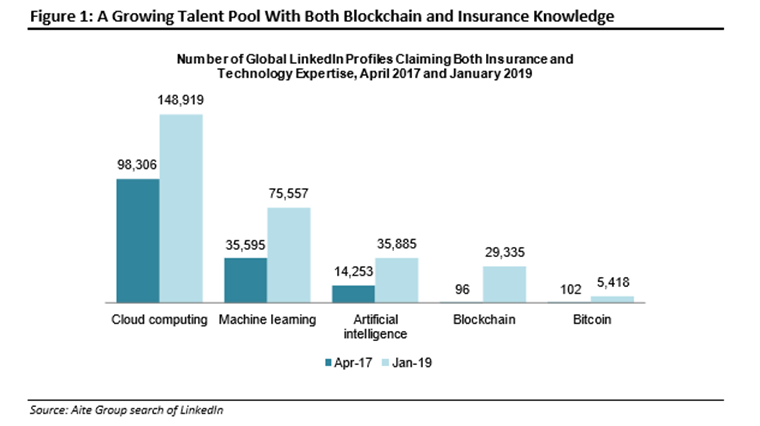

Individuals with technical expertise in both Bitcoin and insurance (based on LinkedIn profiles) soared from 102 in April 2017 to 5,418 in January 2019 (see Figure 1 below). Those with expertise in both blockchain and insurance rose even more dramatically: from 96 to 29,355.

Just 102 self-described insurance professionals claimed Bitcoin expertise in April 2017. By January 2019, that number had jumped to 5,418. | Source: Aite

Blockchain technology, while not completely immature within the insurance industry, still has more development ahead, with many different platforms coming to market in the last two years, according to the report, “Blockchain in Insurance, 2019: A Market Overview.” The report was based on 40 phone interviews with blockchain experts, C-level executives, innovation directors, and thought leaders at insurers, reinsurers, technology vendors, consulting firms, and venture capitalists around the world between October 2018 and January 2019.

“If you are not already involved in a blockchain project, you need to start looking for opportunities to test the waters with a limited use case or low-impact proof of concept,” says Greg Donaldson, senior analyst at Aite Group who authored the report.

AN EXTREME NEED FOR MORE BLOCKCHAIN EXPERTS

Within the insurance industry proper, ‘talent’ growth is even more dramatic (see Figure 2). Only seven individuals professed expertise in both Bitcoin and insurance in April 2017, but 390 did so in January 2019. Only two claimed both insurance and blockchain expertise in 2017, but two years hence 2,260 were so skilled, according to Aite’s LinkedIn analysis.

Blockchain “talent” growth was even more pronounced within the insurance industry proper. | Source: Aite

“The interest in this technology has created an extreme need for more experts who can help the insurance industry develop solutions using blockchain,” notes the report.

Blockchain isn’t expected to disrupt the insurance industry any time soon. Initially, most uses will be aimed at making insurance more transparent and efficient, according to the report. One system, already implemented by Blocksure, for example, keeps all customer information on a ‘permissioned’ blockchain — beginning when a customer is offered a price quotation for a policy. Policy status can be viewed in real time on the blockchain by both the insurer and the customer.

“Then once the customer purchases the policy, the customer knows the status and receives a policy and proof of insurance almost instantly,” explains Aite.

A MORE ‘DISRUPTIVE’ USE CASE

A few vendors, like Black Insurance, an Estonian firm, are offering more radical blockchain solutions, with a goal to upend the entire insurance system. In this model, a broker, not an insurance carrier, creates a new insurance product, then lists that product through Black Insurance to gauge interest in capital markets. Risk is transferred directly to the capital markets, disintermediating (eliminating) traditional insurance carriers entirely. This system, not yet fully implemented, would allow products to come to market faster, reduce fraud through the use of the blockchain platform, and drastically reduce costs by eliminating traditional insurance barriers, according to the vendor.

These more disruptive use cases appear many years away, however, and may never happen, notes Aite. For one thing, regulators may be loathe to allow a system that does not lend itself to oversight.

Insurers themselves will likely slow blockchain adoption “as they are forced to grapple with issues such as data governance, data standards, open networks, sharing proprietary data, and enhanced customer interaction in the insurance process,” notes the report.

About the Author: Andrew W. Singer is an independent data journalist based in New York City. He obtained a Master’s degree in statistics from Columbia University in 2017, and worked as an associate instructor in Machine Learning in Columbia’s MS Program in Applied Analytics — where he became interested in blockchain technology.

No comments:

Post a Comment