Everyone knew a breakout was coming. A tight trading pattern lasted for weeks, which is almost always a precursor to big activity, one way or the other. In the case of Bitcoin and most everything else in the crypto market over the past 24-hours, things went very positive.

Bears lost their stranglehold on the market and plenty of short positions were likely vaporized. Traders in recent weeks had become accustomed to movements of sometimes less than $100 in a whole day. Like as not, plenty of positions were primed for movements of that size. But virtually every market saw Bitcoin go over $3,700 in the past 24 hours, and the rest of the market is lifted as a result.

The increased valuation of Bitcoin had a side effect of bringing Ripple (XRP) back over $0.30. Ethereum’s rise to just under $120 wasn’t enough to launch it into the second spot in the market cap rankings, where Ripple currently sits. This reporter still feels bearish about XRP, at least for the interim. Mass adoption is an important vector in considering the prospects of cryptocurrencies.

FLIPPENING LITE

The other notable happening on the markets was the reshuffling of the top 5 by market capitalization. Litecoin displaced EOS for the fourth spot in the rankings.

Litecoin grew more on its own merit than it did by virtue of the overall market capitalization increase, which was significant. Yesterday, as this capture shows, the overall market cap of the top 10 cryptos was around $95 billion. Today it’s more like over $103 billion.

Judging by the green percentages all the way down the top 100 cryptocurrencies, the money wasn’t coming from other crypto markets. It’s new money. The only big question is: will it stay or run? If we’re in a true bull run, anything is possible. Let’s keep in mind that sharp pops in either direction can often precede massive breaks in the opposite direction.

BITCOIN PRICE STAMPEDES PAST $3,700

After some faltering in the $3,800 range on Bitfinex, Bitcoin is still shuffling up 8%. This is hundreds of dollars per share, in old world terms, which is a significant change that any user will feel. The purchasing power of BTC has increased overnight.

As we said before, the money doesn’t appear to be entering from other wings of the crypto market. Instead, it’s new money. Bitcoin wasn’t the biggest gainer today. Litecoin holds that mantle. But Bitcoin’s gains are serious.

Where will we be Monday? Hardened crypto traders will tell you that’s a long time away. There are plenty of people who bought the extended dip, after all, and could dump on the renewed strong market.

ETHEREUM GETS SOME BREATHING ROOM

Ethereum has officially shoved off the $100 mark, to the relief of everyone. Ether needs to retain a strong market capitalization to float the thousands of tokens it supports.

Versus Bitcoin, Ether pulled out all the stops at Coinbase. If this is an indication as to how trading will go for Bitcoin in the coming days, prepare for a wild ride.

As we can see, most of the price shifts took place this morning. Could there be a psychological aspect to this? Everyone’s been expecting a big movement. At the same time, a comfortable majority of investors believe in the strength of crypto assets. Perhaps a few small changes catalyzed the bigger movements. Deeper data would need to be made public by Coinbase.

Perhaps in the future when decentralized exchanges are the rule of the day, we’ll be better able to analyze the size of the trades that actually precipitate these types of changes.

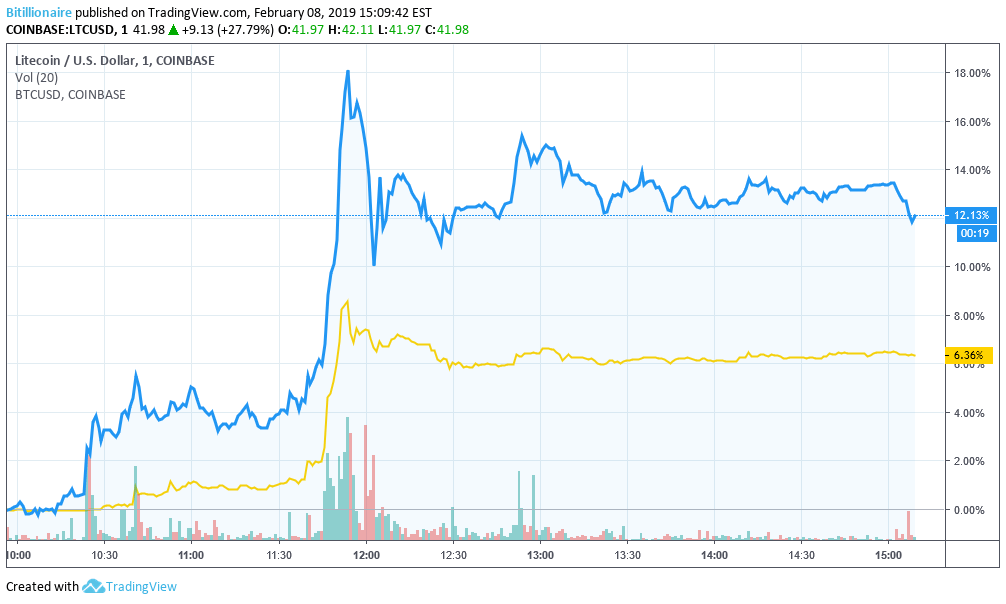

LITECOIN IS ABSOLUTELY KILLING IT

Litecoin’s been playing possum, it seems. Hovering around $30 over the past several weeks, with an occasional dip to $28 or on some markets worse, we were curious what would happen if Bitcoin’s price continued its downward trend but Litecoin’s didn’t.

Litecoin’s volume was double the norm. It also sustained double the gains of Bitcoin percentage-wise. The exercise shows Litecoin is no longer as reliant on Bitcoin as it was.

What we saw today was a similar story, however. Litecoin gained a lot more than any other top 10 crypto. By and large, on a day like this, you can attribute rises to the rise of Bitcoin itself. But Litecoin added half a billion. Charlie Lee reportedly increased confidence in Litecoin with his note that confidential transactions – the type available on Monero or Zcash (or even MimbleWimble) – are coming to LTC.

Litecoin’s future seems bright. It’s managing to maintain its price targets over massive trading volumes. The 24-hour volume for Litecoin was double the usual, at $1.5 billion. If this becomes the new norm, the next move for Litecoin could be back to the #2 market cap spot it hasn’t held for years.

Featured Image from Shutterstock. Price Charts from TradingView.

]

]

No comments:

Post a Comment