Wells Fargo — the third-largest US bank with $2 trillion in assets — will pay a $575 million settlement after admitting that it systematically scammed its own customers for 15 years. Ironically, the fine comes just months after the banking giant dismissed bitcoin as too risky an investment.

Pursuant to a nationwide federal investigation, Wells Fargo admitted that its employees opened more than 3.5 million sham, unauthorized bank and credit card accounts in customers’ names between 2002 and 2017.

The bank then illegally charged its clients for various financial services products they never signed up for, such as life-insurance policies and collateral protection insurance on millions of auto loans.

Employees claimed they engaged in this widespread fraud because were afraid to lose their jobs if they didn’t meet Wells Fargo’s aggressive sales goals.

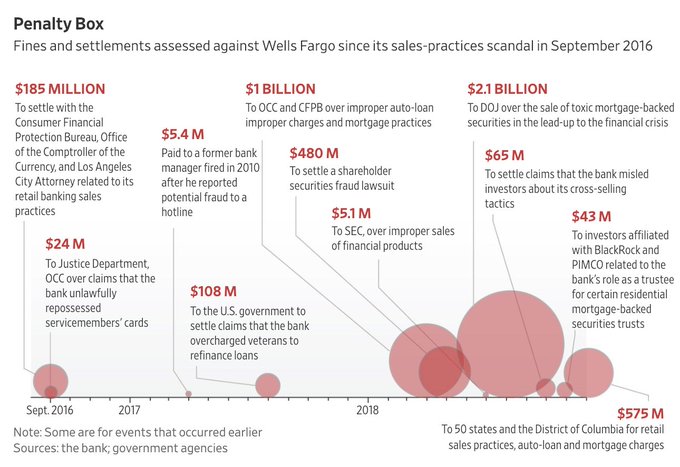

Over $2 Billion in Fines Since 2016

The settlement will be distributed to all 50 US states and the District of Columbia. Wells Fargo will also open a consumer restitution review program, to ensure that anyone who was illegally charged for a service they never authorized gets reimbursed.

The revelation of this fraudulent scheme in 2016 led to the resignation of Wells Fargo’s CEO at the time, John G. Stumpf.

After settling with the Consumer Financial Protection Bureau, Wells Fargo still faces ongoing investigations by the Securities and Exchange Commission, the Department of Justice, and the Department of Labor, according to its most recent securities filing.

Wells Fargo has racked up more than $2 billion in fines since its fake-accounts scandal was revealed in 2016.

California attorney general Xavier Becerra torched Wells Fargo for its gross violation of consumer protection laws.

In a December 28 statement, Becerra said Well Fargo’s unconscionable abuse of its own clients undermines consumer confidence in the banking system.

“Instead of safeguarding its customers, Wells Fargo exploited them, signing them up for products — from bank accounts to insurance — that they never wanted,” Becerra said.

This is an incredible breach of trust that threatens not only the customers who depended on Wells Fargo, but confidence in our banking system. Wells Fargo’s conduct was unlawful and disgraceful.

Irony Alert: Wells Fargo Shades Crypto

Ironically, in June 2018, Wells Fargo banned its customers from using their credits cards to buy cryptocurrencies, as CCN reported. The ban was enacted just as the bitcoin bear market was going into overdrive.

In a statement, Wells Fargo cited the “multiple risks associated with this volatile investment” for its decision.

“Customers can no longer use their Wells Fargo credit cards to purchase cryptocurrency,” a bank rep said in a statement. “We’re doing this in order to be consistent across the Wells Fargo enterprise due to the multiple risks associated with this volatile investment.”

Many in the crypto community say this latest banking scandal is yet another example spotlighting the epic failure of centralized financial institutions.

Between this and the Federal Reserve’s latest interest rate hike (its fourth in 2018), bitcoin evangelists say it’s time to dump corrupt legacy banking systems.

Featured image from Shutterstock.

No comments:

Post a Comment