Morgan Stanley compared an accelerated timeline for bitcoin’s performance to the dotcom era. Sheena Shah, a Morgan Stanley market strategist, in a research report cited in CNBC, painted a potentially grim picture for the future of bitcoin, finding similarities in the price performance and volume levels with the tech-laden Nasdaq at the turn of the century. At one of its lowest times, the bursting of the tech bubble saw companies losing between $10 million and $30 million on a quarterly basis.

For bitcoin, however, it’s all unfolding in a flash.

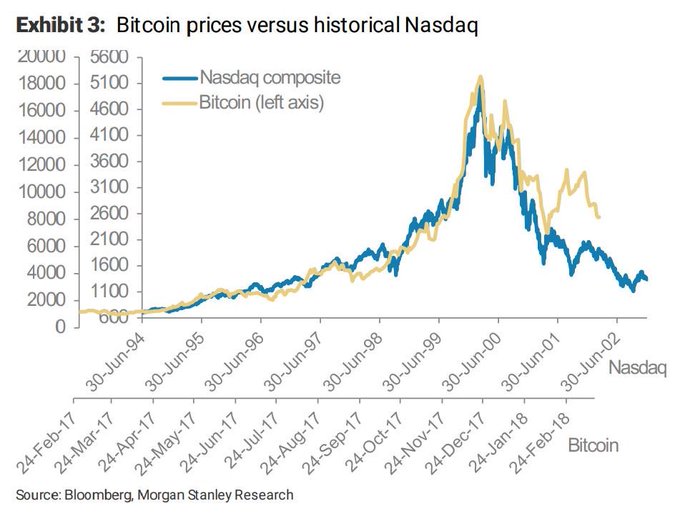

“Bitcoin price weakness has similarities to the Nasdaq in 2000, just occuring at around 15 times the speed,” said Shah.

For instance, Shah looked to market rallies, where both the Nasdaq and bitcoin advanced between 250% and 280% during their peaks foreshadowing declines. There were similar trends in trading volume between the index and the BTC price.

The following is an illustration from the Morgan Stanley report that was subsequently Tweeted by a WSJ reporter. While the time periods are different, with the Nasdaq’s plight unfolding over nearly a decade through 2002 and bitcoin’s activity reflecting a year, the chart appears to prove a pattern. If it’s a harbinger of things to come, the BTC price has not yet reached a floor.

Not so fast, other says, pointing to cracks in the analysis –

Bitcoin Bear Markets

The Morgan Stanley strategist, meanwhile, pointed to four bear markets that bitcoin has endured since its debut in 2009, each of which lasted for an average of five months. During those pullbacks, the price has dropped anywhere from approximately 30% to more than 90% at its worst.

The most recent declines have seen the bitcoin price tumble some 70% from its highs of nearly $20,000 at year-end 2017 to less than $7,300 in recent days. And if history repeats itself, the current bear market could have another couple of months to go.

That places the average decline in the bitcoin price at between 45% and 50% compared to an average 44% drop in the Nasdaq throughout its five bear markets during the tech boom, Shah said.

In addition to price, the Morgan Stanley strategist also compared trading volume, where there were similarities but also some divergences between bitcoin and the Nasdaq.

“The follow-up rally for both bitcoin and the Nasdaq always saw falling trading volumes. Rising trade volumes are thus not an indication of more investor activity but instead a rush to get out,” noted Shah.

As for the differences in trading volume, Shah concludes they could be “interesting.”

In December 2017, they released a report on “Bitcoin Decrypted.” In the report, they highlighted the risks associated with bitcoin investing, ranging from a lack of deposit insurance to the absence of regulation.

Featured image from Shutterstock.

No comments:

Post a Comment