The cryptocurrency market has been highly volatile throughout this week, as major cryptocurrencies including bitcoin, Ethereum, Ripple, and Bitcoin Cash have continued to move in between $340 billion and $380 billion.

Is Bitcoin Ready to Move?

Today, on March 11, the cryptocurrency market recorded a minor recovery after dipping below the $350 billion mark. Briefly, bitcoin fall to $8,320, and the price of Ethereum also fell to $637, significantly below its all-time high established at $1,400.

The daily trading volume of bitcoin has remained relatively low for several days in a row, in the $5 billion region. The high volume of Tether, a cryptocurrency that is backed to the US dollar at a 1:1 ratio, can be considered as a representation of the market’s volatility, given that many traders on the world’s largest cryptocurrency trading platforms utilize Tether to hedge the value of cryptocurrencies to the US dollar.

At the time of reporting, the daily trading volume of Tether remains at $2.3 billion, which is nearly four times higher than that of Litecoin and over $800 million higher than that of Ethereum.

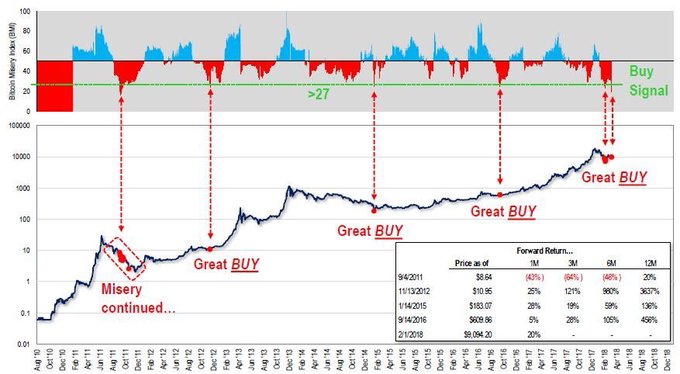

Crypto Rand, a respected cryptocurrency investor and analyst, stated that the “Misery Index” of bitcoin is signaling a buy opportunity for bitcoin investors. Throughout the past six years, upon a dramatic surge in sell volumes, bitcoin has continued to recover from major corrections.

For instance, in December 2016, the price of bitcoin dipped below the $800 mark as sell volumes intensified. But, throughout early 2017, the price of bitcoin rallied to $4,000, eventually achieving $19,000 within the same year.

For instance, in December 2016, the price of bitcoin dipped below the $800 mark as sell volumes intensified. But, throughout early 2017, the price of bitcoin rallied to $4,000, eventually achieving $19,000 within the same year.

It is also important to consider the major factors that are causing the price of bitcoin and other major cryptocurrencies to be extremely volatile. Some state that it is the sell off of Mt. Gox bitcoins, worth over $1.5 billion, that is preventing the market to recover.

If Mt. Gox sell off has been causing the cryptocurrency market to fall, once it stops in the short-term, the market will not be affected by many millions of dollars worth of bitcoin being dumped into the public market, on cryptocurrency exchanges.

As sell volumes decline and the demand for major cryptocurrencies increase again, and the rise of demand coincides with the halted sell off of Mt. Gox bitcoins, the price of bitcoin will likely be able to recover to January 2018 levels, given the current trend.

Ethereum and Alternative Cryptocurrencies

In a volatile period, bitcoin tends to outpeform other major cryptocurrencies and smaller tokens. In the past 24 hours, while the price of Ether has dropped nearly 4 percent, bitcoin has dropped slightly by 2 percent.

Tokens like EOS and Tron, which recorded massive gains on March 10, have also declined by around 4 percent, following the trend of Ethereum.

While some investors like Vinny Lingham expect the price of Ether to outperform bitcoin in the short-term, given that Ethereum has performed much worse than bitcoin over the past few weeks, a large portion of investors still remain confident that newcomers will engage in bitcoin trading first, before considering other assets.

No comments:

Post a Comment