These companies are in favor of SegWit via a User Activated Sof Fork (UASF). No company has opposed it so far.

WHO SUPPORTS UASF

Lately, there has been a lot of talk regarding the possible activation of a User Activated Soft Fork (UASF) in order to implement the SegWit proposal without the need to reach miner consensus. An early look at the companies that have so far taken a stand in regards to the UASF reveals that nine companies support the SegWit UASF, while two others are ready for it. The list is as follows:

- Trezor (Ready)

- Vaultoro (Ready)

- Bitcoin India

- BitcoinReminder

- Bitfury

- BitKong

- Coinkite

- Freedom Node

- JoinMarket

- Samourai Wallet

- Walltime

So far, no company has opposed the User Activated Soft Fork, although most companies have yet to input their stance regarding the subject. BitPay, for example, is not included and they have already announced their support for the UASF. During an episode of Let’s Talk Bitcoin! Bitpay CEO Stephen Pair stated:

The most important thing, I think, are the users; I really like the idea of a user-activated soft fork followed by a miner activation.

It is likely that most companies that support the SegWit soft fork or that are ready for it will take the same stance regarding the UASF since it seems to be the only plausible method of activating SegWit.

With large mining pools like Bitmain supporting Bitcoin Unlimited, it is highly unlikely that SegWit will ever reach the required 95% miner approval threshold unless these pools change their mind on the update. And If the latest accusations regarding the Bitmain’s secret advantage are true, it is unlikely that they’ll even change their stance on SegWit.

WHAT IS A UASF?

A User Activated Soft Fork is a soft fork that does not require miner approval but counts instead on the nodes (users) to activate the soft fork themselves. This is done by releasing a new version of a Bitcoin Client, in this case, Core. The client gives a block height limit in which the upgrade will become active.

Once the predetermined block height is reached, the nodes that have updated to the new client will stop accepting blocks that don’t support SegWit. Given that SegWit is a soft fork, the nodes that don’t upgrade to the new version of the Bitcoin Core client (with UASF) will still count SegWit blocks as valid.

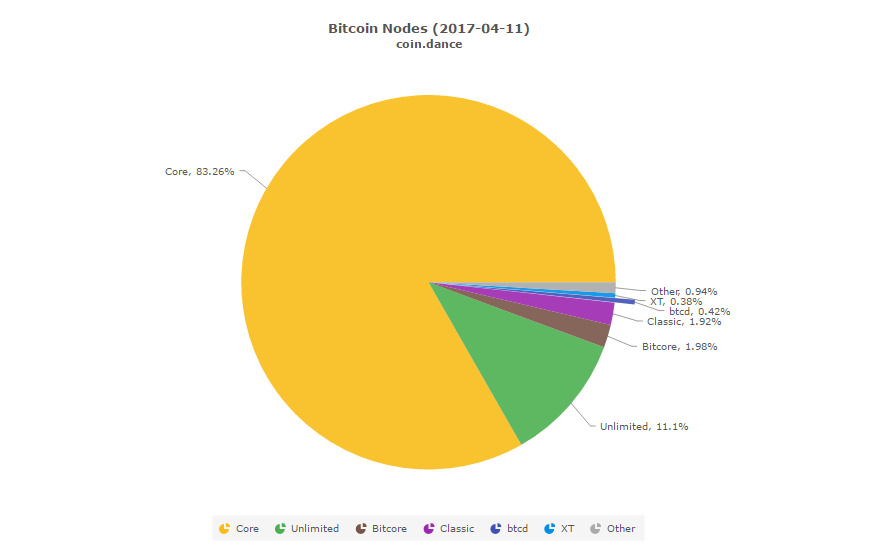

This method makes SegWit much more likely to be adopted when you consider that, currently, more than 83% (5774) of all Bitcoin nodes are running the Bitcoin Core client.

If all of these nodes update to the new UASF client, miners will have no choice but to start mining blocks that support SegWit as these will be accepted by all the nodes, rather than only the ones that haven’t updated to the new Bitcoin Core client.

UASF RISKS

Although the UASF seems like a more effective strategy on paper, it comes with some risks for the community. For example, if the majority of miners don’t start mining SegWit blocks after the UASF is activated, a chain split will take place.

Different nodes will see different blockchains, according to the client they are running. Nodes that have not upgraded to the newest Bitcoin Core client will see the blockchain without SegWit and the upgraded nodes will see the blockchain that supports SegWit.

This scenario is problematic for Bitcoin Core, which has gone a long way to ensuring that SegWit could be introduced via soft fork. It would also mean that the blockchain with the majority of users (nodes) would be the most vulnerable one due to the lack of miners.

Another issue with the UASF is that the cost of setting up nodes is not nearly as good of an anti-Sybil system as Bitcoin’s Proof of Work is, meaning that certain members of the community could start hosting nodes in order to support a UASF or to offer resistance to it. To some degree, this brings back the issue of economic power centralization that has been previously raised with regards to Bitcoin Unlimited.

Will the UASF be successful, bringing SegWit to Bitcoin once and for all? Or will something else get in the way once more? Let us know what you think in the comments below.

Images Courtesy of Coin.Dance, Twitter, AdobeStock

No comments:

Post a Comment